“People are running scared,” said Andrew Sullivan, director at Hong Kong brokerage Pearl Bridge Partners, as the capitalist system faces an economic meltdown.

This is Black Monday all over again. Stock markets around the world, from London to Tokyo, are in free fall. Everything is pointing to a repeat of 2008 but on a higher level. In other words, we are on the verge of a deep world slump.

“Their economic problems will spread just like the virus,” states Ray Dalio, the billionaire capitalist, in a perceptive comment.

European stocks slumped after opening today, with London’s FTSE 100 down 7.7 percent and on track for its worst day since the 2008-09 economic crisis. Wall Street’s S&P 500 plunged seven percent, triggering a 15-minute trading halt and leaving it on track for the heaviest fall since the financial crisis in 2008. Germany’s Dax and France’s Cac 40 fell more than six percent as the Stoxx Europe 600 index, which tracks the region’s largest companies, slid by almost eight percent. Crude oil was on track for its biggest one-day drop since the 1991 Gulf War.

Growth in China is collapsing, falling from 6 percent growth to 2 percent and probably into negative territory, the first time since 1976. Exports have collapsed and imports are down. In February, the manufacturing industry recorded its steepest decline on record. Recent figures from the Financial Times put economic utilisation as low as 20 percent. In the past, China was the motorforce of world capitalism. Now this has been thrown into reverse, with calamitous consequences. Europe is heading for recession, as is Japan. “Emerging economies” face a massive contraction.

The OECD has already warned that world growth could slump to 1.5 percent, but even this looks optimistic.

“The worst for the economy is still to come over the next several months,” Joachim Fels global economic adviser at US asset manager Pimco. He added that a recession in the US and the eurozone in the first half of the year was now “a distinct possibility” and that Japan was “very likely” already in one.

Mr Fels is clearly behind the curve. The slump is unfolding in front of our very eyes. All the zombie companies kept alive by rock-bottom interest rates are about to go under.

More accurate is the comment of Gavekal Research analyst, Tom Holland. “If you ever wondered what would happen if someone lobbed a hand grenade into a bloodbath, now you know. It’s not pretty,” he said.

Sickness in the system

The coronavirus epidemic is not the cause of the crisis, but is a trigger that has set off an economic chain reaction. This will intensify as more and more sectors are caught up in the crisis. It will be like the nuclear meltdown at Chernobyl, where, once the process started, it was unstoppable.

The virus acts as a trigger in the same way as the oil crisis of 1973 precipitated the world slump of 1974, or the bursting of the dot-com bubble triggering the 2000-2001 recession, or the subprime collapse triggering the 2008-9 slump. Even the 1929-33 slump was precipitated by the Wall Street Crash, a product of previous speculation. Each in their own way acted as the catalyst for a deep economic crisis, which was already brewing. Anything could have set it off, any accident could have played this role.

All the measures the central banks took to prolong the so-called “recovery” – the longest recovery on record – will turn into their opposite. They have basically used up all their ammunition for holding off the next slump. But when the slump finally arrives it will be far worse than in the past. This is what is happening now.

The level of government debt around the world has ballooned since the 2008 slump, reaching levels never seen before during peacetime. A Deutsche Bank analysis reveals that the world’s major economies have astronomical debt levels, the highest for the last 150 years, which has become unsustainable.

According to the Financial Times, estimates suggest that world debt levels now exceed $250 trillion, equivalent to a whopping 320 percent of world gross domestic product, half of which is in Japan, China and the United States. This is a house of cards ready to collapse. Now they face the prospect of having to carry out massive bailouts, which could not have come at a worse time.

“By their aggressive actions over the last decade, central banks have effectively trapped themselves into continually intervening in government bond markets. They’re arguably beyond the point of no return,” said Deutsche’s Jim Reid.

With interest rates near zero, some banks are in grave difficulties at this point, as profit margins are compressed. The Fed has just cut its rate and others are likely to follow, but this will make no difference to the wider economy, and will further undermine some banks. But they have no alternative. While JP Morgan is making lots of money, others, like the Bank of America, with its cheap deposit base, has lost $80bn in market capitalisation in just a few weeks. Silicon Valley Bank has lost more than a third of its value. There are 5,200 banks, small and medium, in the US which are about to be hit badly, soon to be gobbled up by the big banks.

The spread of globalisation, which benefited capitalism by intensifying world trade, is now being pushed into reverse. The extensive supply chains, the just-in-time production lines, face massive disruption. All the factors that promoted the boom are dialectically turning into their opposite.

According to Resilinc, a California-based group that tracks millions of parts to map the supply chain, discovered that some 1,800 manufactured components were made in the quarantined areas of China.

“The scariest thing we see is the highest numbers of parts [made in and around Hubei] are caps and resistors — tiny things nobody cares about — plus thermal components, plastics and resins, and sheet metals,” said Bindiya Vakil, Resilinc’s chief executive

This is the modern equivalent of throwing a spanner into the works. Or the flapping of butterfly wings that creates a hurricane at the other end of the world.

She warned that “no supply chain will be unscathed” and went on to predict that 70 percent of global manufacturing companies could be cut off from supplies of incidental parts. Ford was in this position in 2011 and was forced, alongside others, to shut down factories.

As Peter Hasenkamp, who was involved in the supply chain plan for the Tesla Model S, said: “It takes 2,500 parts to build a car, but only one not to.”

Meltdown

With this economic meltdown, compounded by the coronavirus, which threatens to become a pandemic, the central banks and governments appear helpless.

Ray Dalio, the billionaire and co-chairman of Bridgewater Associates, issued a blunt, but realistic, warning. “Looking back to periods in history when this configuration of circumstances occurred,” he says ominously, “the last time was in the 1930s”.

“Anyone who is knowledgeable and plain-speaking will tell you that the negative economic impact of the coronavirus outbreak will probably be big, that monetary policy will be of little use to counteract it, and that coordination between political leaders and central bankers is both essential and unlikely,” he wrote.

“While the emergence of coronavirus, and the economic shock that will come from it, is a surprise, several things have been obvious for some time… it has been clear that an economic downturn would someday come from one trigger or other.” (Financial Times, 9/3/20)

What he says is absolutely correct. This crisis is going to be big. On the same scale as the 1930s. But the policies that the bourgeois would usually employ to deal with it are now largely useless. The world situation has never been so precarious. Furthermore, the coronavirus is an “accident”, and that it should only be regarded as a “trigger”, as the economic crisis was inevitable at a certain point.

He continues: “Now imagine adding the twin health and economic shocks delivered by the outbreak and where that will lead. Imagine many companies suffering debilitating revenue losses, some too indebted because of persistently cheap money and other incentives to borrow, that will force them to cut payments to their employees and default on their debts.”

In other words, business will cut wages and default on their debts. There will be widespread bankruptcies, which will have a further knock-on effect. They are terrified that, with companies defaulting on their debts, the corporate debt markets, where levels of “leverage” and overall indebtedness have been rising, could easily seize up. “Financial strains that worsen the downturn are a major risk,” said Adam Slater, lead economist at Oxford Economics.

While the Fed cut interests by a small amount and is likely to trim it further to zero, the European Central Bank (ECB) is trying to catch up. After saying a few weeks ago that the prospects of the European economy looked rosey, they now face a recession, with a third of Italy’s population already in lockdown. The economies of France and Italy both shrank in the final quarter of last year, while Germany’s flatlined. For the eurozone economy, which at 1.2 percent in 2019, had already slowed to its lowest growth rate for seven years, the crisis could hardly be less opportune.

“The one billion dollar question is: how long will it last?” said Jörg Asmussen, a former ECB chief economist. “Is it temporary? How many months before a V-shape recovery starts?”

Hope springs eternal in the human breast. After a few months, they think everything will be back to normal. Given the scale of the crisis, and this is only the beginning, many are looking at nine months or a year. But we are in uncharted waters.

Christine Lagarde, the head of the ECB, is caught between a rock and a hard place. Unlike the Fed, the ECB has kept interest rates at zero and have now run out of options. It actually cut rates as early as September to a record low of minus 0.5 percent. This amounts effectively to paying the bank to keep your money!

Lagarde herself said recently that this has “significantly reduced the scope” to cut rates further. You don’t say! And these people are the top strategists of capital. No wonder there have been open disagreements in the ECB over policy. When you are on the edge of an erupting volcano, it is difficult to think clearly.

The financial markets believe the ECB will be forced to act. They have factored in a further measly rate cut to minus 0.6 percent. But this will get them nowhere. This desperate policy is like taking steroids, which can be highly effective in small doses but not over the longer term, as they weaken the system. Put simply, the drugs do not work.

They are talking about targeting loans to businesses, but this is like taking a fly swat to a plague of locusts. It demonstrates how impotent they are in face of this crisis of capitalism.

This is looking like a rerun of the 2008 slump, but possibly deeper. Back then, they did manage to bailout the capitalist system and avoid a new depression. That was also thanks to the colossal resources pumped into the Chinese economy, that kept the world economy afloat.

No way out

Today, trade tensions have already risen and an incipient trade war is going on between China and the United States, despite a fragile agreement; and between the United States and Europe. With a collapse of the world economy and world trade, the capitalist powers will be seeking to escape their problems by imposing them on others. This can lead to a beggar-thy-neighbour policy being adopted, as well as competitive devaluations. This is what happened in 1930, and the adoption in the US of the Smoot-Hawley Tariff Act and the opening of a trade war. This was disastrous and ended with the world depression of the 1930s.

This can easily happen now with Trump in the White House, who has adopted an “America First” policy. His instincts align with protectionism, which can very easily turn a slump into a depression. Once it begins, it will be extremely difficult to stop. It will be a chain reaction, where other countries also adopt protectionism to safeguard their interests.

We already are witnessing a trade (price) war between Saudi Arabia and Russia, and Russia and the United States over oil prices, where the price of crude oil has fallen from $65 a barrel to $30 a barrel today. It has been the biggest price drop since the Gulf War in 1991, but can fall much further, possibly to $20. We are on a far-sharper downward trajectory.

There is a debate amongst bourgeois economists as to what kind of crisis we have, a supply crisis, demand crisis, simply a financial shock — or some combination of the three?

They are incapable of understanding that this is a classic crisis of capitalism. They have been educated and brought up on the understanding that capitalism can never be subject to deep crises. They have learned nothing from the 2008 slump: the deepest crisis facing capitalism in its history.

Their dilemma was summed up by Martin Wolf, chief economist at the Financial Times in the middle of 2009:

“Today, they are struggling with the deepest recession since the 1930s, a banking system on government life-support and the danger of deflation. How can it have gone so wrong?”

He went on: “Most of us – I was one – thought we had at last found the Holy Grail. Now we know it was a mirage.” (FT, 6/5/09).

Crisis inevitable

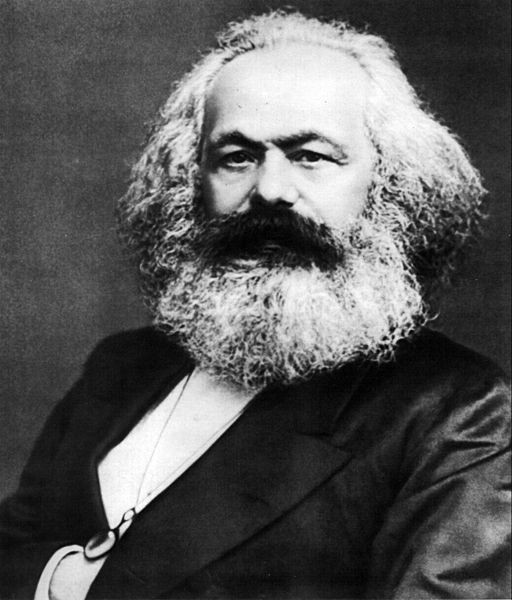

It was Karl Marx who uncovered the contradictory laws of the capitalist economy, which is an anathema to the bourgeois economists. They are influenced by the French economist, Jean Baptist Say, who defended the idea of economic equilibrium under capitalism. But there is no such equilibrium.

Today’s economists, like David Ricardo before them, “cannot admit that the bourgeois mode of production contains within itself a barrier to the free development of the productive forces, a barrier which comes to the surface in crises and, in particular, in overproduction – the basic phenomenon in crises,” as Marx put it. (‘Theories of Surplus-Value, part 2’, pp.527-528)

The development of capitalism contains within itself the seeds of a slump. They can keep the capitalist system going by credit and other artificial means, but it sooner or later reaches its limits. “Banking and credit thus became the most potent means of driving capitalist production beyond its own limits,” explained Marx. However, he added tellingly, “and one of the most effective vehicles of crises and swindle.” (Capital, vol.3, p.593)

Again, he explains, “In a system of production where the entire interconnection of the reproduction process rests on credit, a crisis must evidently break out if credit is suddenly withdrawn and only cash payment is accepted. At first glance, therefore, the entire crisis presents itself as simply a credit and monetary crisis.” (Capital, vol.3, p.621)

The productive forces under capitalism have outgrown the market. There is a huge stockpile of cars, steel, aluminium and other commodities, and there are even more factories that are idle or running slow because the order books are empty. The bourgeois economists call this “excess capacity”. But it is a reflection of overproduction and the fact that the system has reached its limits. That is why they can only use 80 percent of capacity in a boom and only 70 percent in a slump. In November 2019, capacity utilisation in US manufacturing was 75.1 percent. In China, industrial utilisation was 76.1 percent for the third quarter of 2019, reflecting widespread over-capacity even in a “recovery”.

This is a reflection of an organic crisis of the capitalist system. Private ownership and the nation state have become absolute fetters on the development of society. The basis of crisis in capitalism is where the system reaches its limits. According to Marx, the barrier to the development of capital is capital itself. The working class cannot buy back the product that they produce. While the capitalists can overcome this contradiction by ploughing back this surplus value into capital investment, it only increases productive capacity and leads to more production. The market cannot keep up with this and at a certain point there is a crisis of overproduction.

The basis for capitalist crisis is laid in the previous period. However, for it to occur it requires an “accident” to push the system over the edge. This is what has happened now. All the factors that promoted the boom, now come together to propel the downturn, even a depression. Given all the combustible material that exists worldwide, this slump can be devastating.

Such a scenario will shatter governments everywhere. They will try to make the working class pay for the crisis, as in 2008-20, with the epoch of austerity. However, the working class will fight back. More than ever before, the question of the overthrow of capitalism will enter the minds of the masses. Revolutionary movements will be on the order of the day.